From Man vs. Machine to Man+ Machine: The Art and AI of Stock Analyses

The research paper "From Man vs. Machine to Man + Machine" delves into the evolving relationship between human expertise and artificial intelligence (AI) in the context of stock analysis. At its core, the paper investigates how an AI analyst, trained on corporate disclosures, industry trends, and macroeconomic indicators, performs in comparison to human analysts in predicting stock prices. The study finds that AI excels in environments where information is abundant and transparent, while human analysts have an edge in situations requiring deep institutional knowledge, particularly for firms with intangible assets or complex financial structures. Interestingly, the gap between human and machine performance narrows over time, suggesting that human analysts are adapting by incorporating AI and machine learning tools into their analyses.

Five Key Takeaways:

- AI's Relative Performance: The AI analyst outperforms human analysts in general, beating them in over 55% of the predictions. This suggests AI's superior ability to process voluminous information and its immunity to human biases.

- Human Edge in Complexity: Human analysts perform better than AI when analyzing firms that are smaller, more illiquid, have higher intangible assets, or are in dynamically competitive industries, indicating the value of human intuition and understanding in complex scenarios.

- Adaptation and Narrowing Gap: Over time, the performance gap between human analysts and AI narrows, highlighting human analysts' adaptability and their increasing use of AI tools.

- Man + Machine Superiority: A combined approach, where human analysts leverage AI insights, outperforms either human analysts or AI alone in making stock price predictions.

- Avoiding Extreme Errors: The Man + Machine model is significantly better at avoiding extreme prediction errors than either humans or AI on their own, showcasing the complementary strengths of combining human expertise with AI capabilities.

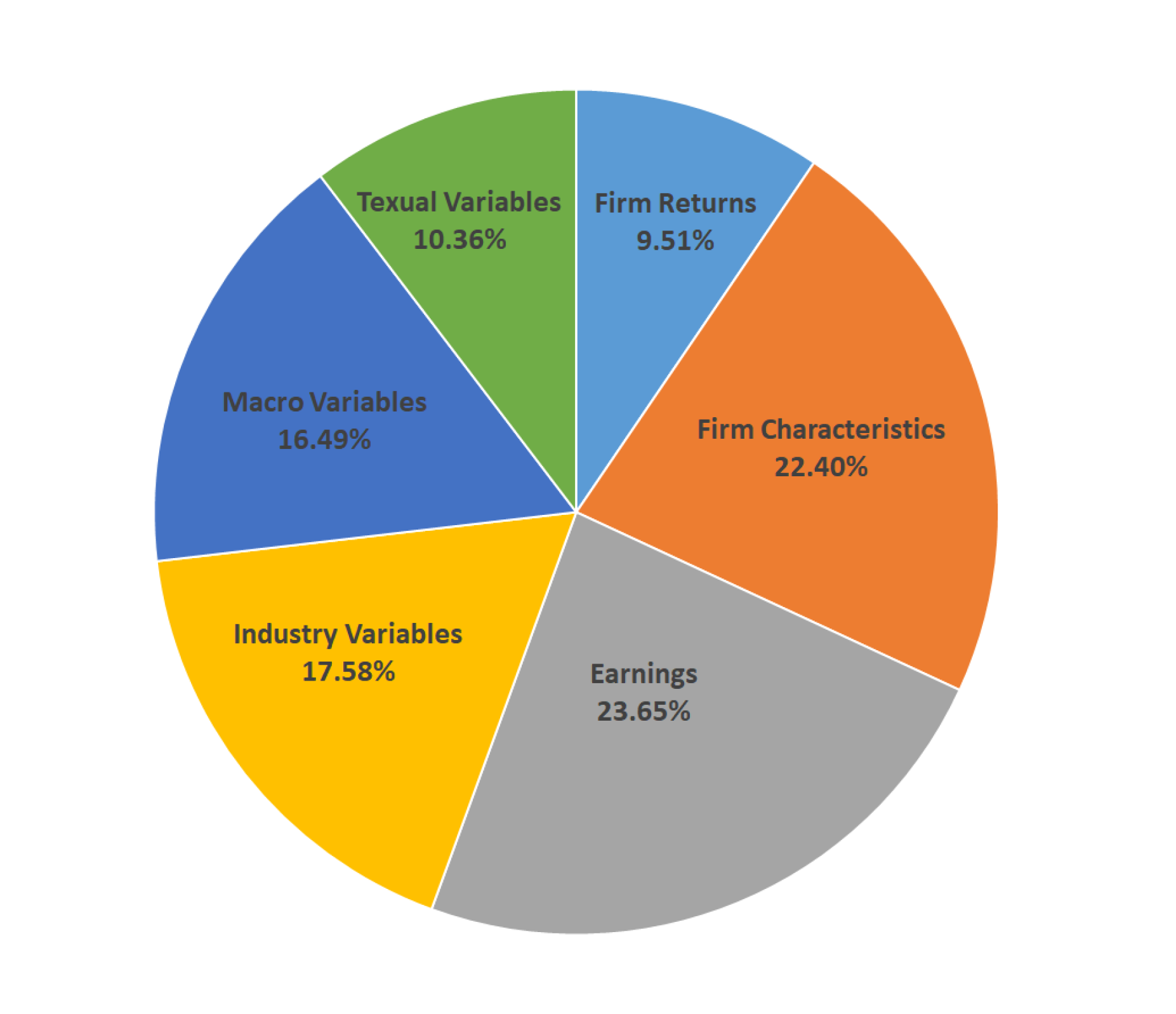

How different information contributes to the prediction accuracy of the AI?

- Dominance of Firm Characteristics and Earnings Data: The figure likely shows that firm-specific attributes and historical earnings information are among the most significant contributors to the AI's prediction accuracy. This finding suggests that AI models heavily rely on quantitative financial data and historical performance metrics to forecast future stock prices, leveraging their ability to process and analyze vast datasets efficiently.

- Significant Role of Industry and Macroeconomic Factors: The analysis might reveal that industry trends and macroeconomic indicators also play a crucial role in informing the AI's predictions. This indicates that beyond firm-level data, broader economic and sector-specific dynamics are vital in shaping accurate stock forecasts, highlighting the AI's capacity to integrate diverse information streams.

- Value of Textual Sentiment Analysis: Another key insight from this figure could be the substantial impact of sentiment analysis on the AI's predictive performance. By quantifying the qualitative aspects of corporate disclosures and news, the AI model incorporates nuanced insights that go beyond traditional financial metrics, showcasing the advanced capabilities of machine learning in extracting meaningful patterns from unstructured data.

- Lesser Influence of Past Returns: The figure might also indicate that past stock returns contribute the least to the AI's forecasting accuracy. This observation could suggest that the AI model places more emphasis on fundamental analysis over technical indicators, or it might reflect the efficient market hypothesis where past returns have limited predictive power for future prices.

MAN + MACHINE: How good we can predict together?

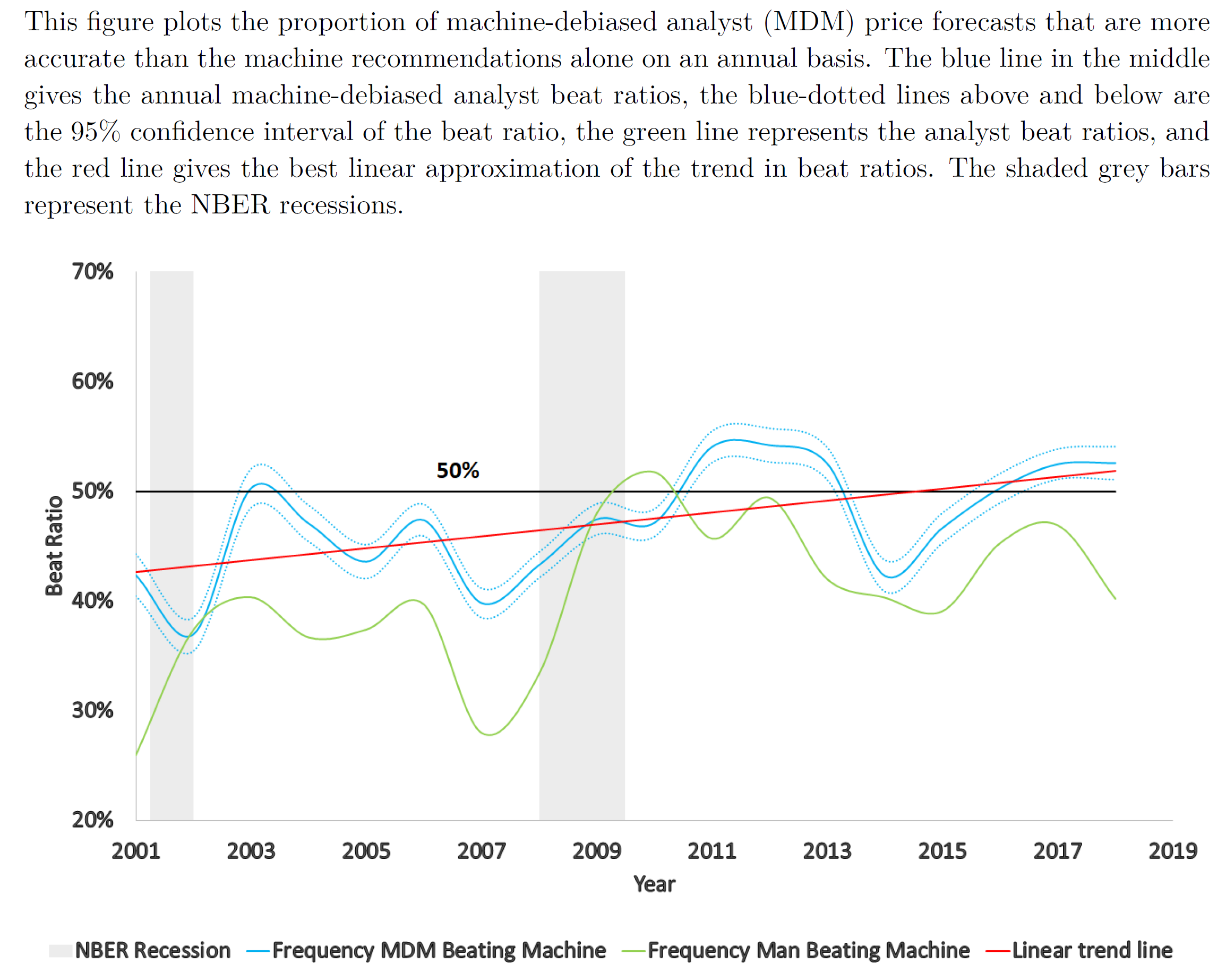

The above figure illustrates the evolving dynamics between human analysts, AI, and their collaborative efforts (Man + Machine) in predicting stock prices from 2001 to 2018. This figure underscores the initial superiority of AI in processing vast amounts of data and its resilience against human biases. However, it also highlights sectors where human analysts hold an edge—particularly in analyzing companies with substantial intangible assets or complex financial structures. Most notably, this figure demonstrates the narrowing performance gap over time, reflecting human analysts' increasing adaptability and their growing integration of AI tools into their analyses.

See our summary video:

Read the full paper here: