Deep Learning Statistical Arbitrage

Strategy with Sharpe Ration of 3.2

The research paper titled "Deep Learning Statistical Arbitrage" provides an innovative approach to statistical arbitrage using deep learning methodologies. Statistical arbitrage, a quantitative trading strategy that exploits temporal price differences between similar assets, has long been employed by hedge funds and investment banks. The authors develop a comprehensive conceptual framework and a novel data-driven solution to construct arbitrage portfolios, extract time-series signals, and form optimal trading policies to maximize risk-adjusted returns. Through an extensive empirical study on daily US equities, the paper demonstrates that their deep learning approach to statistical arbitrage significantly outperforms traditional methods, yielding consistently high mean returns and Sharpe ratios.

Five Key Takeaways:

- Innovative Framework for Statistical Arbitrage: The paper introduces a novel deep learning framework for statistical arbitrage that combines asset pricing models with machine learning techniques to identify arbitrage opportunities in the U.S. equity market effectively.

- Superior Performance: The proposed deep learning model significantly outperforms traditional statistical arbitrage strategies, demonstrating the potential for higher returns and better risk-adjusted performance through the use of advanced data analysis techniques.

- Comprehensive Empirical Analysis: The empirical study, covering daily returns of approximately 550 of the largest and most liquid U.S. stocks from 1998 to 2016, validates the model's effectiveness in real-world trading environments.

- Importance of Time-Series Signal Extraction: The research highlights the critical role of extracting accurate time-series signals for successful arbitrage trading. The convolutional transformer model used for signal extraction outperforms other models by capturing complex price patterns and temporal dependencies.

- Feasibility and Profitability in Practical Trading: Despite market frictions and transaction costs, the proposed arbitrage strategy remains profitable, demonstrating its feasibility for real-world trading applications. The strategy is not only profitable but also stable over time and across different market conditions.

Deep Learning Arbitrage Model

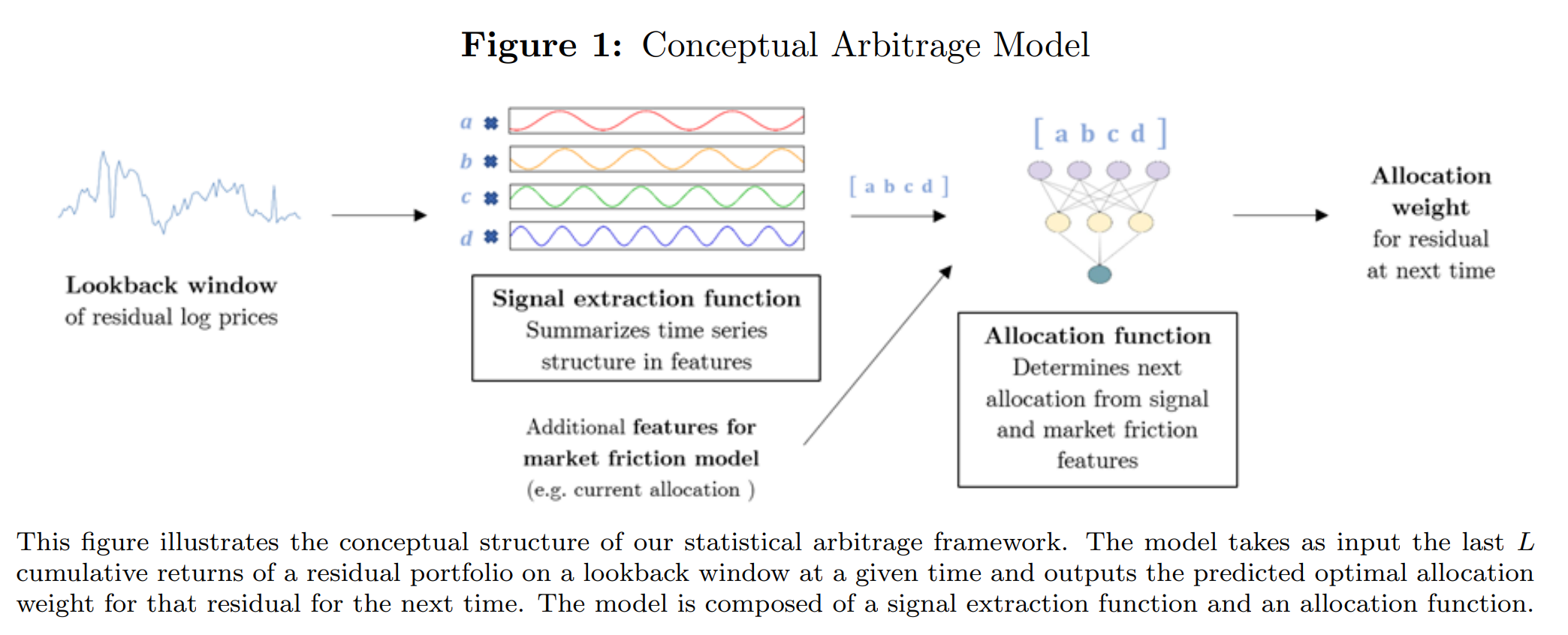

This figure provides a schematic overview of the statistical arbitrage framework used in the research. Here’s a simplified explanation of the figure:

- Lookback Window of Residual Log Prices: This part of the diagram shows the historical price data for an asset, specifically focusing on the residuals, which are the returns that can't be explained by common risk factors. The lookback window is the period over which past data is considered for analysis.

- Signal Extraction Function: The signal extraction function processes the historical data to identify meaningful patterns or features that can be used to predict future price movements. This step summarizes the time-series data into a structured format that can be analyzed more effectively.

- Additional Market Friction Features: Here, additional inputs may be considered, such as current allocation or other market friction indicators that could influence the investment decision.

- Allocation Function: The allocation function takes the features identified by the signal extraction function, along with any additional features, to decide the optimal weight of the asset in the portfolio for the next trading period. This is where the model determines how much to invest in the particular asset based on the expected profitability of the arbitrage opportunity.

- Allocation Weight for Residual at Next Time: The output of the model is the actual decision of how much to allocate to the arbitrage opportunity at the next trading opportunity. This could mean taking a long or short position in the asset based on the predicted price movement.

In essence, this figure maps out the flow from historical price data through a series of analytical steps to arrive at a trading decision. The model incorporates both the identification of price patterns and the practical considerations of market conditions to forecast the most profitable allocation strategy.

Cumulative Performance Over Time

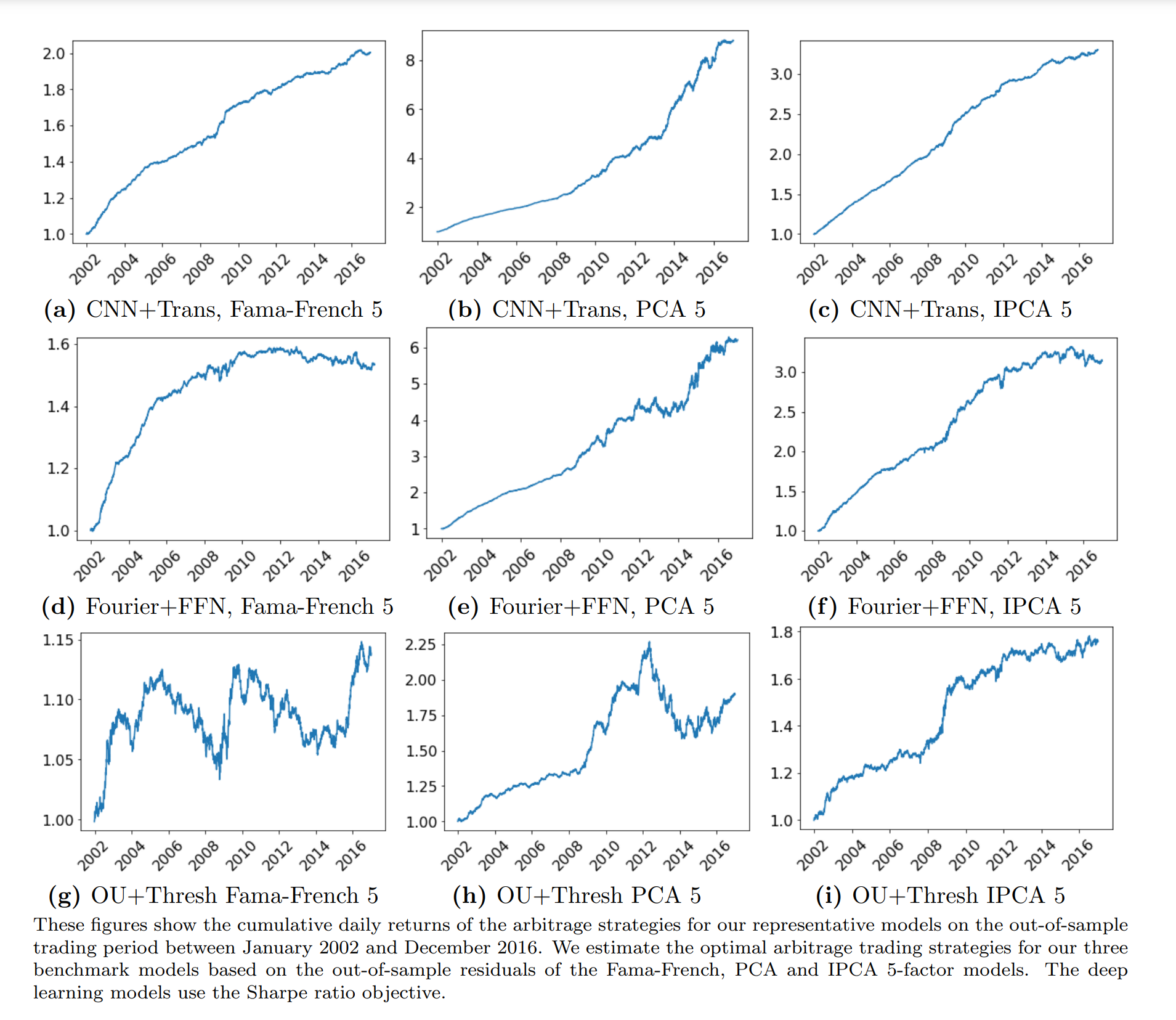

This figure shows the cumulative daily returns of arbitrage strategies applied using different models based on the out-of-sample residuals of the Fama-French, PCA, and IPCA 5-factor models from January 2002 through December 2016. Each subfigure shows the growth of $1 invested using the respective strategy over the period.

The deep learning models using the Sharpe ratio objective have been applied, and it's evident that the CNN+Transformer approach, particularly with IPCA factors, results in a strong and consistent performance over time. This comprehensive visualization underscores the potential of deep learning techniques in statistical arbitrage and the importance of selecting the right factors and models for maximizing returns.

Check out our video summary:

Read the full paper here: